Understanding Gold’s Safety Appeal for Indian Investors

When it comes to gold investment, Indians have always placed their trust in the yellow metal. For centuries, gold has been more than just an ornament—it’s a symbol of wealth, security, and financial stability. In a country where economic uncertainties and market fluctuations are common, gold stands out as a safe investment option in India that has consistently protected wealth across generations.

But what makes gold investment truly safe? In this comprehensive guide, we’ll explore why gold remains the safest investment choice for Indian investors, the best gold investment plans in India, and how you can start your own gold investment journey.

The Cultural and Financial Trust in Gold

Gold holds a unique position in Indian culture. It’s interwoven with traditions, festivals, and life milestones like weddings and religious ceremonies. Indians collectively own approximately 25,000 tonnes of gold, making India one of the largest gold holders globally. Beyond tradition, this trust stems from real-world experience—families have witnessed how gold preserved their wealth during wars, economic downturns, and currency devaluations.

What Makes an Investment “Safe”?

A safe investment typically exhibits three key characteristics: capital preservation, stable returns, and low risk of total loss. Unlike stocks that can become worthless or real estate that may face legal complications, gold maintains intrinsic value regardless of market conditions. Safety also means liquidity—the ability to convert your investment to cash quickly without significant loss.

Reasons Why Gold Investment Is the Safest Option in India

1. Tangible Asset with Intrinsic Value: Gold is a physical asset you can see, touch, and store. This tangibility provides psychological comfort and real security that digital investments cannot match.

2. Physical Ownership vs Paper Assets: When you invest in physical gold—whether jewellery, coins, or bars—you own something with inherent value. Unlike company shares that depend on business performance, gold’s value exists independently. Even if financial systems collapse, your gold retains worth. This makes gold particularly valuable in times of geopolitical uncertainty or banking crises.

3. Protection Against Inflation and Currency Depreciation: Gold has historically been an excellent hedge against inflation. When the cost of living rises and currency purchasing power declines, gold prices typically increase proportionally.

4. How Gold Preserves Purchasing Power: Consider this a gold sovereign coin that could buy a quality suit in the 1960s can still buy a quality suit today. In India, where inflation has averaged 5-7% annually over decades, holding gold ensures your wealth doesn’t erode over time. As the rupee weakens against global currencies, gold priced in international markets provides a natural buffer.

5. Low Market Volatility Compared to Stocks: While gold prices do fluctuate, these movements are typically far less dramatic than stock market swings.

6. Historical Stability During Economic Crises: Gold’s performance during crises demonstrates its safety credentials. During the 2008 financial crisis, while major stock indices crashed 50-60%, gold prices actually increased. In 2020’s COVID-19 pandemic, gold reached all-time highs of ₹56,000+ per 10 grams. This counter-cyclical behavior makes gold an excellent portfolio diversifier.

7. High Liquidity and Universal Acceptance: One of gold’s strongest safety features is its exceptional liquidity. You can sell gold almost anywhere in India—from local jewellers to banks to online platforms.

8. Easy Conversion to Cash When Needed: Unlike real estate that may take months to sell, gold can be converted to cash within hours. Banks also readily accept gold as collateral for loans, often providing up to 75% of the gold’s value at competitive interest rates. This liquidity without selling makes gold uniquely flexible among safe investments.

9. Best Gold Investment Plans in India: Understanding how to invest in gold requires knowing the various options available. Each gold investment plan suits different needs and risk appetites.

10. Physical Gold: Jewellery, Coins, and Bars: Physical gold remains the most popular choice among Indian investors. Gold jewellery serves dual purposes—investment and adornment—while coins and bars are pure investment vehicles.

Pros and Considerations

Advantages: Complete ownership, no counterparty risk, emotional satisfaction, inheritance value, and immediate possession.

Considerations: Making charges on jewellery (15-25%), storage and security concerns, purity verification (look for BIS hallmark), and GST of 3% plus customs duty. For pure investment, gold coins and bars are preferable as they carry lower making charges.

Digital Gold and Gold ETFs: Modern technology has made gold investment more accessible through digital platforms and exchange-traded funds.

Modern Investment Alternatives

1. Digital Gold allows you to buy gold online starting from as little as ₹100. The purchased gold is stored in secure vaults, and you can take physical delivery anytime or sell back digitally.

2. Gold ETFs are mutual fund units backed by physical gold that trade on stock exchanges like shares, offering no storage worries, high liquidity, lower costs, and transparency in pricing. Both options suit investors who want gold exposure without physical storage hassles.

3. Sovereign Gold Bonds (SGBs): Issued by the Reserve Bank of India, SGBs represent perhaps the most financially attractive gold purchase plan available.

- Government-Backed Security with Interest: SGBs offer unique advantages: 2.5% annual interest paid semi-annually, capital gains tax exemption if held till maturity (8 years), government guarantee on gold value, and no storage or purity concerns. For long-term investors, SGBs combine gold’s safety with additional income.

4. Gold Saving Schemes with Monthly Instalments: Gold saving schemes with monthly plans have become increasingly popular, especially among middle-class families looking to accumulate gold systematically.

- How Monthly Gold Investment Plans Work: Jewellers across India offer schemes where you pay a fixed monthly amount (typically ₹2,000-₹10,000) for 11 months. In the 12th month, the jeweller adds a bonus equivalent to one month’s installment, allowing you to purchase gold jewellery worth 12 months of investment. This systematic approach makes gold investment affordable and disciplined.

- Benefits of Gold Jewellery Subscription Plans: Best jewellery subscription plans offer several advantages: no lump sum requirement, disciplined savings habit, protection from price increases through rupee cost averaging, flexibility to choose jewellery at maturity, and bonus benefits that reduce effective gold cost. These trusted gold saving schemes India offers make gold accessible to everyone.

How to Invest in Gold: A Practical Guide

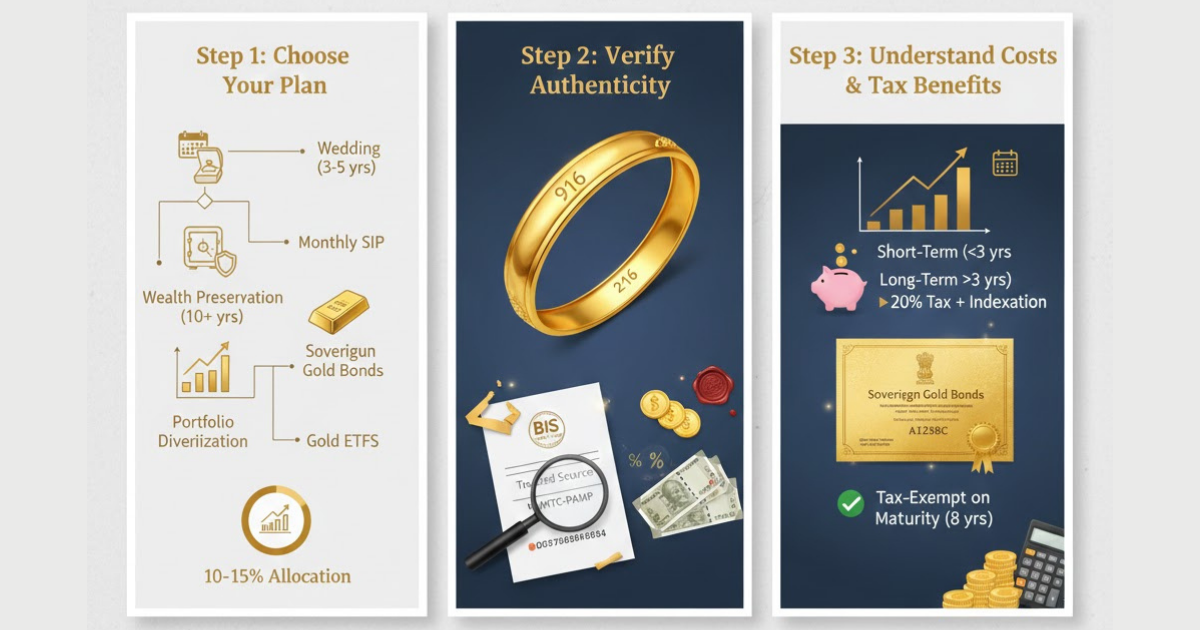

Step 1: Choose the Right Gold Investment Plan

Your choice should align with your financial situation and goals.

Matching Plans to Your Financial Goals

1. For Wedding Planning (3-5 years): Consider monthly gold investment plans that help accumulate gold systematically.

2. For Wealth Preservation (10+ years): Sovereign Gold Bonds offer the best combination of safety and returns with tax benefits on gold investment India.

3. For Portfolio Diversification: Gold ETFs provide easy entry and exit with minimal transaction costs.

Financial advisors typically recommend allocating 10-15% of your portfolio to gold for optimal risk management.

Step 2: Verify Authenticity and Certification

Never compromise on gold purity and authenticity—it’s the foundation of your investment’s safety.

BIS Hallmarking Standards: Always insist on BIS (Bureau of Indian Standards) hallmarked gold. Since June 2021, hallmarking is mandatory for gold jewellery in India. The hallmark includes BIS logo, purity grade (916 for 22 karat, 999 for 24 karat), jeweller’s identification mark, and six-digit HUID. For coins and bars, purchase only from reputed manufacturers like MMTC-PAMP or certified dealers.

Step 3: Understand Costs and Tax Benefits

Tax Benefits on Gold Investment in India

1. Capital Gains Tax: Short-term (held <3 years) is added to income and taxed as per slab; long-term (held >3 years) attracts 20% with indexation benefit.

2. Tax-Free Options: Sovereign Gold Bonds held till maturity (8 years) have capital gains completely tax-exempt. Proper tax planning can significantly improve your effective returns from gold investment.

Gold Saving Schemes in Delhi NCR: Safe Investment Options

Why Gold Saving Schemes Are Popular in India: Gold saving schemes with monthly instalment options democratize gold investment. Instead of requiring large upfront capital, these schemes allow families to invest what they can afford monthly, aligning with salary cycles and creating automatic savings discipline.

Trusted Gold Saving Schemes with Monthly Plans: When selecting schemes, look for jewellers with long-standing reputation (10+ years in business), clear written terms and conditions, transparent pricing with no hidden charges, and customer testimonials. Reputed jewellers in Delhi NCR and across India offer schemes with varying bonus structures.

Gold Purchase Plans Available in Delhi NCR: Delhi NCR, being a major metropolitan region, offers diverse gold purchase plans from traditional jewellers to modern fintech platforms.

Benefits of Choosing Local Jewellers: Local jewellers in Delhi NCR provide personal relationships and trust, physical verification of gold quality, customization options, after-sales services, and easy dispute resolution. Many established Delhi NCR jewellers now also offer digital platforms where you can buy gold investment plan online while still having access to physical stores.

Common Mistakes to Avoid When Investing in Gold

Ignoring Making Charges and Hidden Costs: Many first-time investors focus only on gold prices and overlook making charges, which can significantly reduce returns. If you buy jewellery at ₹50,000 with 20% making charges (₹10,000), you’re actually paying ₹60,000. When selling, you’ll only receive the gold value, creating an immediate loss. For pure investment, choose coins, bars, or digital gold with minimal premiums.

Not Diversifying Gold Investment Types: Putting all your gold investment into one form reduces flexibility. A balanced approach might include 40% in physical gold for emergency liquidity, 30% in SGBs for long-term growth, 20% in Gold ETFs for easy rebalancing, and 10% in monthly saving schemes for future jewellery needs.

Buying Without Proper Research: Impulse purchases during festivals often lead to poor decisions. Always compare current gold prices across multiple sources, verify seller credentials, understand complete cost structure including taxes, check buyback policies, and read scheme terms thoroughly before committing.

Conclusion: Start Your Safe Investment Journey with Gold

Gold investment stands as India’s most trusted wealth preservation tool for compelling reasons. Its tangible nature, inflation protection, historical stability, and exceptional liquidity make it a cornerstone of financial security. The best approach combines different gold investment plans—physical gold for immediate needs, digital gold for convenience, SGBs for long-term growth, and monthly saving schemes for systematic accumulation.

Remember that gold should complement, not replace, your complete investment portfolio. Aim for 10-15% allocation in gold, balanced with other safe instruments for holistic financial health.

Visit Dream Ticket today to explore the best gold investment plans in India and start building your golden wealth systematically. Don’t wait for the “right time”—with monthly investment plans, every day is the right time to start securing your family’s future with gold.